Beauty & Cosmetic Insurance Coverage Backed by Experience

Running a beauty business means working closely with clients, products, and specialist equipment — all of which carry potential risks. From allergic reactions to accidental damage, one unexpected incident could lead to claims, downtime, or reputational harm.

That’s why having comprehensive protection in place is essential. Our policies are designed to safeguard your services, support your growth, and give you peace of mind so you can focus on what you do best: helping people feel confident in their skin.

Insurance Coverage for Beauty Business

Public Liability Insurance

Public Liability insurance covers you if a member of the public is injured or has their property damaged as a result of your business activities. For example, if a client slips on a wet floor in your salon or suffers a reaction during treatment, this cover helps with compensation claims and legal costs. It’s essential for anyone interacting with the public, from solo practitioners to busy clinics.

Product Liability Insurance

If you sell, supply, or manufacture skincare or cosmetic products, this protects you in the event a customer suffers harm from using them — such as rashes, burns, or allergic reactions. Even if you didn’t create the product, you can still be held liable as a supplier. This is critical for e-commerce sellers, salons selling aftercare items, and independent skincare brands.

Workers’ Compensation Insurance

This coverage is legally required if you employ staff to assist with your support work. It ensures your team is protected in the event of workplace injuries or illnesses, covering medical expenses, lost wages, and rehabilitation costs.

Treatment Risk Cover

This specialist protection is designed for professionals performing hands-on treatments like facials, waxing, tinting, microdermabrasion, or chemical peels. It covers compensation claims if a treatment causes unexpected harm or distress to a client, even if you followed all protocols. It’s tailored for beauticians, aestheticians, skin therapists, and similar roles.

Professional Indemnity Insurance

If your business involves giving advice or guidance, such as skin consultations or recommending treatment plans, Professional Indemnity insurance covers steps if a client claims your advice led to a negative outcome or financial loss. It includes legal defence and compensation costs and is increasingly important as beauty services become more personalised and consultative.

Business Equipment Insurance

This protects your professional tools and equipment — including laser machines, treatment beds, diagnostic tools, or portable kits — against theft, accidental damage, or loss. If your equipment is vital to your income, having it insured means you won’t be left out of pocket if something goes wrong.

How We Support Beauty and Skincare Businesses

At Pivotal Insurance Brokers, we specialise in working with beauty professionals across Australia. We understand your treatments, your tools, and the trust your clients place in you, so we build policies to match.

Here’s what sets us apart:

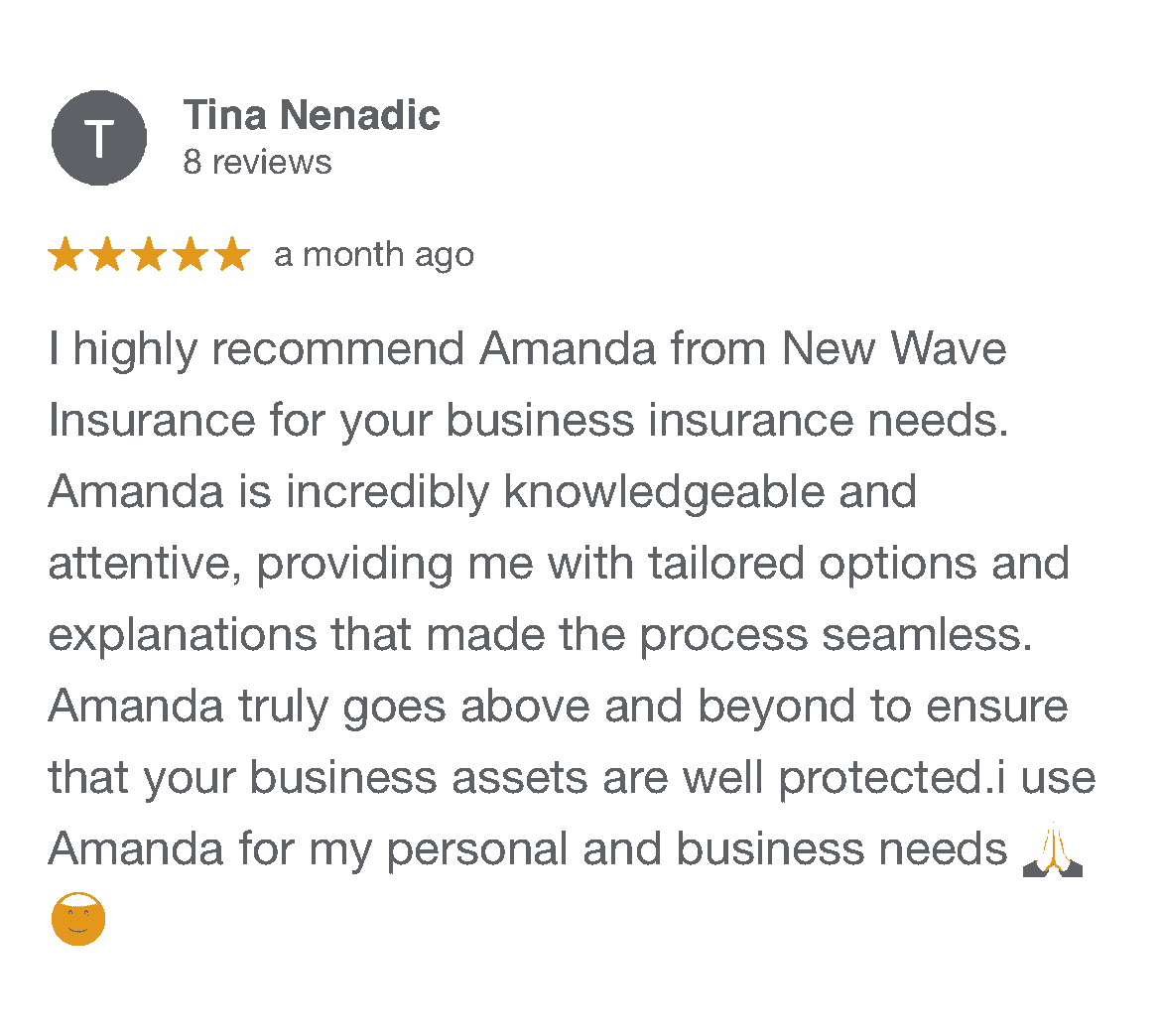

• Tailored policies – We’ll recommend a cover that fits your services and risk profile, not a one-size-fits-all approach.

• Straightforward process – Simple quotes, no jargon, and support when you need it.

• Responsive claims team – Fast, friendly claims service when the unexpected happens.

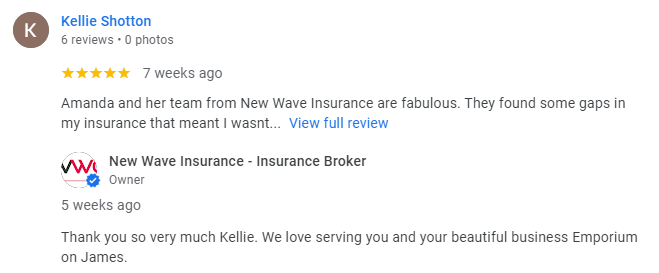

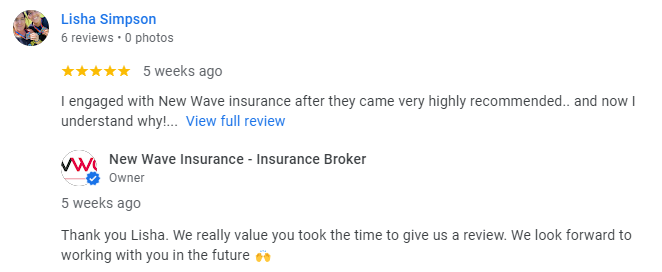

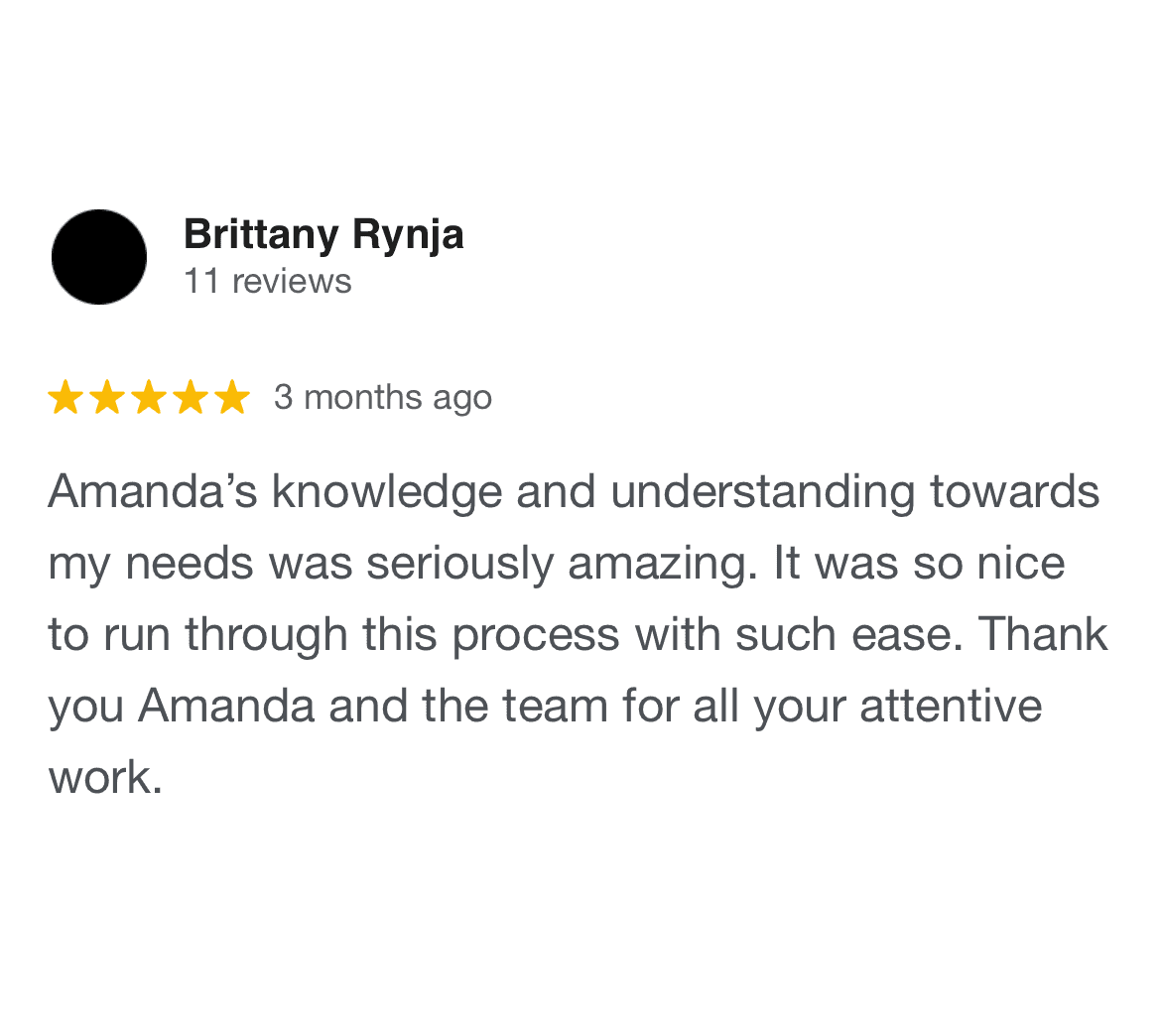

• Trusted by professionals – From boutique skincare brands to freelance therapists, our clients rely on us to keep their businesses protected.

Frequently Asked Questions

Yes. Home-based businesses face many of the same risks, including client injuries and product issues. We’ll help ensure your setup is properly protected.

Most non-invasive cosmetic and skincare treatments can be included. We’ll tailor the policy to match your services.

Absolutely. Selling cosmetic or skincare products means you need product liability insurance to cover any customer reactions or issues.

Yes. Whether you travel to clients or rent space in a salon, we offer flexible coverage that moves with you.

In most cases, we can arrange your cover within one business day.